- Home

- About

- Practices

Cruise Ship AccidentsCLASS ACTION LAWSUITSMaritimePersonal Injury

- Results

- Blogs/News

- Free Consultation

- 866-597-4529

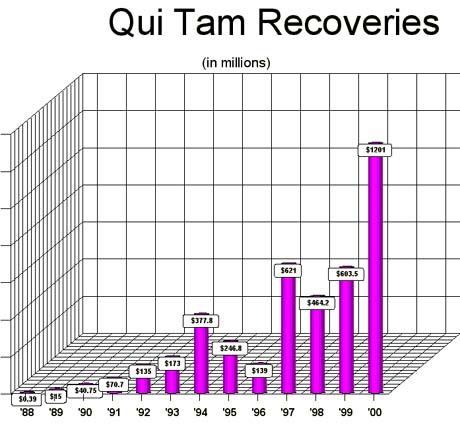

Individuals may be entitled to a reward for bringing forth a whistleblower or Qui Tam case to the government. The False Claims Act (FCA) was enacted in 1863 by the United States Congress, over concerns that there were groups defrauding the Federal government.

The law is complex, but it essentially states that any person who “knowingly submits” a false claims to the government either to get money or property or to avoid having to pay money that would be due is liable for double the government’s damages plus a penalty of $2,000 for each false claim. Since 1863, the FCA has been amended many times.

A suit filed by an individual on behalf of the government is known as a “qui tam” action, and the person bringing the action is referred to as a “Relator.” In 1986, damages were changed from double to treble (three times) raising the penalties from $2,000 to $10,000. Since 1986 the FCA has been amended three more times.

In order for a claim to qualify as a False Claim, it must be knowingly submitted to the government with the following:

A valid False Claims Act case includes any kind of fraudulent demand that is made directly to the Federal Government or to a contractor, grantee, or other recipient when the money is to be spent on the government’s behalf not including tax claims under the Internal Revenue Code.

Once a qui tam complaint is filed and served initially upon the appropriate U.S. Attorney, the Department of Justice has 60 days to investigate the allegations contained in the complaint. Often times, due to the complexity of the allegations contained in the complaint, the government cannot complete its investigation in 60 days, and can seek extensions of the seal period while it continues its investigation.

If, after investigating the allegations contained in the complaint, the Government decides to prosecute take the case on against the defendant, it must notify the Judge. When this happens it is called “intervening.”

When the government intervenes in a whistleblower case, it takes on the role as the lead attorney and also the plaintiff. In other words, the Department of Justice’s attorneys will head the litigation and the United States becomes the plaintiff or injured party.

This means, that the Department of Justice’s lawyers are able to settle the case and/or they can decide to simply dismiss it at any time; even over a Realtor’s objection. However, if the Relator objects to a settlement, the judge must provide the Relator an opportunity for a court hearing to determine if the proposed settlement is fair.

Likewise, if the Relator wants to settle or dismiss his or her qui tam action, it must also obtain the government’s permission. Under certain circumstances, the government and the defendant can ask the Judge to limit a Relator’s participation in the litigation.

Relators are entitled to receive between 15 and 25% of the amount recovered by the government through the qui tam action, in all cases where the government intervened. The reward money is paid to the relator by the government out of the payment received by the government from the defendant.

In qui tam action litigations where the government declined the case, the relator’s reward is increased to 25 to 30% of the recovery.

There are certain circumstances when a reward may be reduced by the Court, but never to less than 10%. However, if the Court finds that the relator actually planned or participated in the fraud, the Court may reduce the award without limitation.

In addition to a cash reward, whistleblowers are also entitled to be repaid any of their own legal fees and case-related costs by the defendant.

There are several circumstances where a Relator is banned from filing a whistleblower case and they are as follows:

Our whistle blower claims lawyers in Florida are very passionate about assisting people in filing Qui Tam cases against individuals and businesses that have bilked and misappropriated our taxpayer’s dollars. If you are aware of a potential False Claim, it is important that you discuss your matter with an experienced lawyer. It is important to be the first and only person to file the claim before it becomes public record.

If you believe that you have a potential whistleblower claim, please email me or call our office today for a free initial consultation at 1-866-597-4529. We investigate cases across the country and work closely with the Department of Justice to ensure that our clients receive the full amount of any compensation they are entitled to. Most importantly, we want to protect all of our hard earned taxpayer dollars.

Aronfeld Trial Lawyers is a firm of high-profile, nationally recognized legal advocates who work for you, our client, never big business. We represent cases resulting in serious injuries in the areas of Cruise Ship Injuries, Wrongful Death, Automobile Accidents, Cycling Accidents, Slip and Fall Incidents, Product Liability, Civil Rights Claims, Workplace Injuries, Maritime Law, Sexual Assault, Medical and Dental Malpractice, and others.

Quick Links

Contact Us

Let’s Work Together

©Aronfeld. 2024 KCoWeb All Rights Reserved